go-financial

This package is a go native port of the numpy-financial package with some additional helper

functions.

The functions in this package are a scalar version of their vectorised counterparts in

the numpy-financial library.

Currently, only some functions are ported,

which are as follows:

| numpy-financial function | go native function ported? | info |

|---|---|---|

| fv |

|

Computes the future value |

| ipmt |

|

Computes interest payment for a loan |

| pmt |

|

Computes the fixed periodic payment(principal + interest) made against a loan amount |

| ppmt |

|

Computes principal payment for a loan |

| nper | Computes the number of periodic payments | |

| pv |

|

Computes the present value of a payment |

| rate | Computes the rate of interest per period | |

| irr | Computes the internal rate of return | |

| npv |

|

Computes the net present value of a series of cash flow |

| mirr | Computes the modified internal rate of return |

Index

While the numpy-financial package contains a set of elementary financial functions, this pkg also contains some helper functions on top of it. Their usage and description can be found below:

- Amortisation(Generate Table)

- Fv(Future value)

- Pv(Present value)

- Npv(Net present value)

- Pmt(Payment)

- IPmt(Interest Payment)

- PPmt(Principal Payment)

Detailed documentation is available at godoc.

Amortisation(Generate Table)

To generate the schedule for a loan of 20 lakhs over 15years at 12%p.a., you can do the following:

package main

import (

"time"

financial "github.com/razorpay/go-financial"

"github.com/razorpay/go-financial/enums/frequency"

"github.com/razorpay/go-financial/enums/interesttype"

"github.com/razorpay/go-financial/enums/paymentperiod"

)

func main() {

loc, err := time.LoadLocation("Asia/Kolkata")

if err != nil {

panic("location loading error")

}

currentDate := time.Now().In(loc)

config := financial.Config{

// start date is inclusive

StartDate: currentDate,

// end date is inclusive

EndDate: currentDate.AddDate(15, 0, 0).AddDate(0, 0, -1),

Frequency: frequency.ANNUALLY,

// AmountBorrowed is in paisa

AmountBorrowed: 200000000,

// InterestType can be flat or reducing.

InterestType: interesttype.REDUCING,

// interest is in basis points

Interest: 1200,

PaymentPeriod: paymentperiod.ENDING,

Round: true,

}

amortization, err := financial.NewAmortization(&config)

if err != nil {

panic(err)

}

rows, err := amortization.GenerateTable()

if err != nil {

panic(err)

}

// Generates json output of the data

financial.PrintRows(rows)

// Generates a html file with plots of the given data.

financial.PlotRows(rows, "20lakh-loan-repayment-schedule")

}

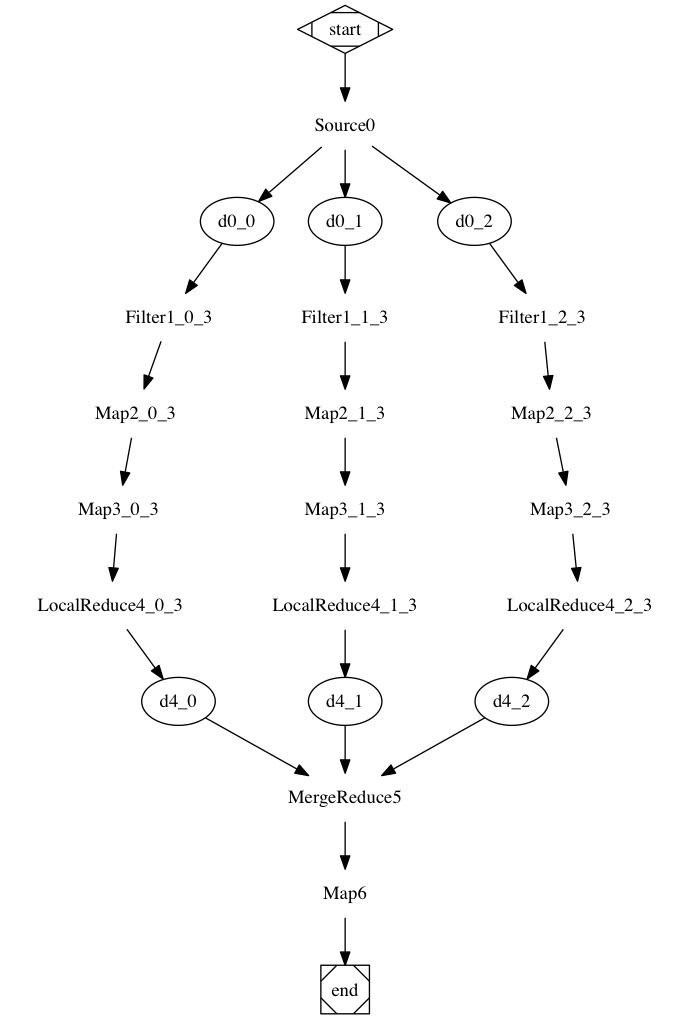

Generated plot

Fv

func Fv(rate float64, nper int64, pmt float64, pv float64, when paymentperiod.Type) float64

Params:

pv : a present value

rate : an interest rate compounded once per period

nper : total number of periods

pmt : a (fixed) payment, paid either at the beginning (when = 1)

or the end (when = 0) of each period

when : specification of whether payment is made at the beginning (when = 1)

or the end (when = 0) of each period

Fv computes future value at the end of some periods(nper).

Example(Fv)

If an investment has a 6% p.a. rate of return, compounded annually, and you are investing ₹ 10,000 at the end of each year with initial investment of ₹ 10,000, how much amount will you get at the end of 10 years ?

package main

import (

"fmt"

gofinancial "github.com/razorpay/go-financial"

"github.com/razorpay/go-financial/enums/paymentperiod"

"math"

)

func main() {

rate := 0.06

nper := int64(10)

payment := float64(-10000)

pv := float64(-10000)

when := paymentperiod.ENDING

fv := gofinancial.Fv(rate, nper, payment, pv, when)

fmt.Printf("fv:%v", math.Round(fv))

// Output:

// fv:149716a

}

Pv

func Pv(rate float64, nper int64, pmt float64, fv float64, when paymentperiod.Type) float64

Params:

fv : a future value

rate : an interest rate compounded once per period

nper : total number of periods

pmt : a (fixed) payment, paid either

at the beginning (when = 1) or the end (when = 0) of each period

when : specification of whether payment is made

at the beginning (when = 1) or the end

(when = 0) of each period

Pv computes present value some periods(nper) before the future value.

Example(Pv)

If an investment has a 6% p.a. rate of return, compounded annually, and you wish to possess ₹ 1,49,716 at the end of 10 peroids while providing ₹ 10,000 per period, how much should you put as your initial deposit ?

package main

import (

"fmt"

gofinancial "github.com/razorpay/go-financial"

"github.com/razorpay/go-financial/enums/paymentperiod"

"math"

)

func main() {

rate := 0.06

nper := int64(10)

payment := float64(-10000)

fv := float64(149716)

when := paymentperiod.ENDING

pv := gofinancial.Pv(rate, nper, payment, fv, when)

fmt.Printf("pv:%v", math.Round(pv))

// Output:

// pv:-10000

}

Npv

func Npv(rate float64, values []float64) float64

Params:

rate : a discount rate compounded once per period

values : the value of the cash flow for that time period. Values provided here must be an array of float64

Npv computes net present value based on the discount rate and the values of cash flow over the course of the cash flow period

Example(Npv)

Given a rate of 0.281 per period and initial deposit of 100 followed by withdrawls of 39, 59, 55, 20. What is the net present value of the cash flow ?

package main

import (

"fmt"

gofinancial "github.com/razorpay/go-financial"

"math"

)

func main() {

rate := 0.281

values := []float64{-100, 39, 59, 55, 20}

npv := gofinancial.Npv(rate, values)

fmt.Printf("npv:%v", math.Round(npv))

// Output:

// npv: -0.008478591638455768

}

Pmt

func Pmt(rate float64, nper int64, pv float64, fv float64, when paymentperiod.Type) float64

Params:

rate : rate of interest compounded once per period

nper : total number of periods to be compounded for

pv : present value (e.g., an amount borrowed)

fv : future value (e.g., 0)

when : specification of whether payment is made at the

beginning (when = 1) or the end (when = 0) of each period

Pmt compute the fixed payment(principal + interest) against a loan amount ( fv = 0).

It can also be used to calculate the recurring payments needed to achieve a certain future value given an initial deposit, a fixed periodically compounded interest rate, and the total number of periods.

Example(Pmt-Loan)

If you have a loan of 1,00,000 to be paid after 2 years, with 18% p.a. compounded annually, how much total payment will you have to do each month? This example generates the total monthly payment(principal plus interest) needed for a loan of 1,00,000 over 2 years with 18% rate of interest compounded monthly

package main

import (

"fmt"

gofinancial "github.com/razorpay/go-financial"

"github.com/razorpay/go-financial/enums/paymentperiod"

"math"

)

func main() {

rate := 0.18 / 12

nper := int64(12 * 2)

pv := float64(100000)

fv := float64(0)

when := paymentperiod.ENDING

pmt := gofinancial.Pmt(rate, nper, pv, fv, when)

fmt.Printf("payment:%v", math.Round(pmt))

// Output:

// payment:-4992

}

Example(Pmt-Investment)

If an investment gives 6% rate of return compounded annually, how much amount should you invest each month to get 10,00,000 amount after 10 years?

package main

import (

"fmt"

gofinancial "github.com/razorpay/go-financial"

"github.com/razorpay/go-financial/enums/paymentperiod"

"math"

)

func main() {

rate := 0.06

nper := int64(10)

pv := float64(0)

fv := float64(1000000)

when := paymentperiod.BEGINNING

pmt := gofinancial.Pmt(rate, nper, pv, fv, when)

fmt.Printf("payment each year:%v", math.Round(pmt))

// Output:

// payment each year:-71574

}

IPmt

func IPmt(rate float64, per int64, nper int64, pv float64, fv float64, when paymentperiod.Type) float64

IPmt computes interest payment for a loan under a given period.

Params:

rate : rate of interest compounded once per period

per : period under consideration

nper : total number of periods to be compounded for

pv : present value (e.g., an amount borrowed)

fv : future value (e.g., 0)

when : specification of whether payment is made at the

beginning (when = 1) or the end (when = 0) of each period

Example(IPmt-Loan)

If you have a loan of 1,00,000 to be paid after 2 years, with 18% p.a. compounded annually, how much of the total payment done each month will be interest ?

package main

import (

"fmt"

gofinancial "github.com/razorpay/go-financial"

"github.com/razorpay/go-financial/enums/paymentperiod"

"math"

)

func main() {

rate := 0.18 / 12

nper := int64(12 * 2)

pv := float64(100000)

fv := float64(0)

when := paymentperiod.ENDING

for i := int64(0); i < nper; i++ {

pmt := gofinancial.IPmt(rate, i+1, nper, pv, fv, when)

fmt.Printf("period:%d interest:%v\n", i+1, math.Round(pmt))

}

// Output:

// period:1 interest:-1500

// period:2 interest:-1448

// period:3 interest:-1394

// period:4 interest:-1340

// period:5 interest:-1286

// period:6 interest:-1230

// period:7 interest:-1174

// period:8 interest:-1116

// period:9 interest:-1058

// period:10 interest:-999

// period:11 interest:-939

// period:12 interest:-879

// period:13 interest:-817

// period:14 interest:-754

// period:15 interest:-691

// period:16 interest:-626

// period:17 interest:-561

// period:18 interest:-494

// period:19 interest:-427

// period:20 interest:-358

// period:21 interest:-289

// period:22 interest:-218

// period:23 interest:-146

// period:24 interest:-74

}

Example(IPmt-Investment)

If an investment gives 6% rate of return compounded annually, how much interest will you earn each year against your yearly payments(71574) to get 10,00,000 amount after 10 years

package main

import (

"fmt"

gofinancial "github.com/razorpay/go-financial"

"github.com/razorpay/go-financial/enums/paymentperiod"

"math"

)

func main() {

rate := 0.06

nper := int64(10)

pv := float64(0)

fv := float64(1000000)

when := paymentperiod.BEGINNING

for i := int64(1); i < nper+1; i++ {

pmt := gofinancial.IPmt(rate, i+1, nper, pv, fv, when)

fmt.Printf("period:%d interest earned:%v\n", i, math.Round(pmt))

}

// Output:

// period:1 interest earned:4294

// period:2 interest earned:8846

// period:3 interest earned:13672

// period:4 interest earned:18786

// period:5 interest earned:24208

// period:6 interest earned:29955

// period:7 interest earned:36047

// period:8 interest earned:42504

// period:9 interest earned:49348

// period:10 interest earned:56604

}

PPmt

func PPmt(rate float64, per int64, nper int64, pv float64, fv float64, when paymentperiod.Type, round bool) float64

PPmt computes principal payment for a loan under a given period.

Params:

rate : rate of interest compounded once per period

per : period under consideration

nper : total number of periods to be compounded for

pv : present value (e.g., an amount borrowed)

fv : future value (e.g., 0)

when : specification of whether payment is made at

the beginning (when = 1) or the end (when = 0) of each period

Example(PPmt-Loan)

If you have a loan of 1,00,000 to be paid after 2 years, with 18% p.a. compounded annually, how much total payment done each month will be principal ?

package main

import (

"fmt"

gofinancial "github.com/razorpay/go-financial"

"github.com/razorpay/go-financial/enums/paymentperiod"

"math"

)

func main() {

rate := 0.18 / 12

nper := int64(12 * 2)

pv := float64(100000)

fv := float64(0)

when := paymentperiod.ENDING

for i := int64(0); i < nper; i++ {

pmt := gofinancial.PPmt(rate, i+1, nper, pv, fv, when, true)

fmt.Printf("period:%d principal:%v\n", i+1, math.Round(pmt))

}

// Output:

// period:1 principal:-3492

// period:2 principal:-3544

// period:3 principal:-3598

// period:4 principal:-3652

// period:5 principal:-3706

// period:6 principal:-3762

// period:7 principal:-3818

// period:8 principal:-3876

// period:9 principal:-3934

// period:10 principal:-3993

// period:11 principal:-4053

// period:12 principal:-4113

// period:13 principal:-4175

// period:14 principal:-4238

// period:15 principal:-4301

// period:16 principal:-4366

// period:17 principal:-4431

// period:18 principal:-4498

// period:19 principal:-4565

// period:20 principal:-4634

// period:21 principal:-4703

// period:22 principal:-4774

// period:23 principal:-4846

// period:24 principal:-4918

}